Community

SMALL is the New Big — Embracing Efficiency in the Age of AI

The new mark of a standout Founder is no longer how big they can make their staff — it's how small they can keep it.

Oh, how times have changed, my friends. For hundreds of years, we graded the value and success of a company based on how "big" it had become, and headcount was always the leading indicator. "We've scaled to 1,000 people!" would have been the badge of honor up until the past year, and now it begs the most obvious question, "Why?"

We're entering the Age of Efficiency, where we are rewarded not for a bloated headcount but for a tiny headcount that can produce even greater output. And I've got to say — I couldn't be happier about it because, as startups, this is the dream we've all been waiting for.

In Case You Missed It

The 9 Best Growth Agencies for Startups

What an exciting moment! You’re looking to scale up your startup and need to bring in a growth agency to help you do that. But, it’s a big decision. Choosing the wrong agency will lead to months of delayed growth, thousands of dollars in wasted spend, and difficult conversations down the line trying to understand where it all went wrong.

This means it is vitally important you make the right decision from the get-go. There are hundreds of marketing agencies out there, but if you are in the startup phase of growth I’d recommend going with a startup growth agency that has experience in the earlier stages.

I have done some of the research for you by putting together a list of the top 9 startup agencies I know deliver great results. So, at least...

Never Share Your Net Worth

"Never tell anyone how much money you have. They will only judge you by it or try to take it from you."

That was some of the best advice I've ever gotten from the son of a well-known billionaire after my first startup just started to take off. At the time, I had just started to make some money, and like any poor kid who just came into some cash, I wanted the whole world to know just how well I had done.

So yeah, I was the douchebag posting pictures of my Lamborghini, only social media didn't exist yet, so I guess I was just emailing them, which is way worse! Little did I know at the time how much trouble my personal PR campaign would create for me.

They Will Only Judge You by it

One of the things I first started noticing was that everyone w...

This is BOOTSTRAPPED — 3 Strategies to Build Your Startup Without Funding

Most startups launch with $0 in funding, but no one ever really explains how the hell they do it. We keep saying, "They bootstrapped it," as if that explains anything other than "They didn't take on investors." What the heck does that even mean? What it is intended to mean is that we find creative ways to compensate people and buy things that don't involve using cash in the bank.

We can't possibly cover every use case of how startups find resources for $0, but let's take a look at the most popular categories that people run around looking for money for and see how we make it work.

Paying for People

Figuring out how to compensate people is where we're often stuck first. Most of us are familiar with paying folks with equity, but that's not th...

The Ridiculous Spectrum of Investor Feedback

How do you know if the advice you just got from an investor on your fundraise was any good?

(Spoiler: it's probably terrible advice, and you're about to waste a lot of time following it.)

We review thousands of pitch decks at Startups.com, and as part of that process, we hear countless tales of Founders having gotten "really strong advice" from an investor they talked with about their deal. They get super hung up on changing everything to accommodate this feedback.

My question is always, "Who was the investor, and what were their qualifications to give that advice?"

Whenever I ask, the Founder says "Well... they are an INVESTOR!" as if claiming that title is tantamount to irrefutable knowledge. Look, I invest in the stock market, but that d...

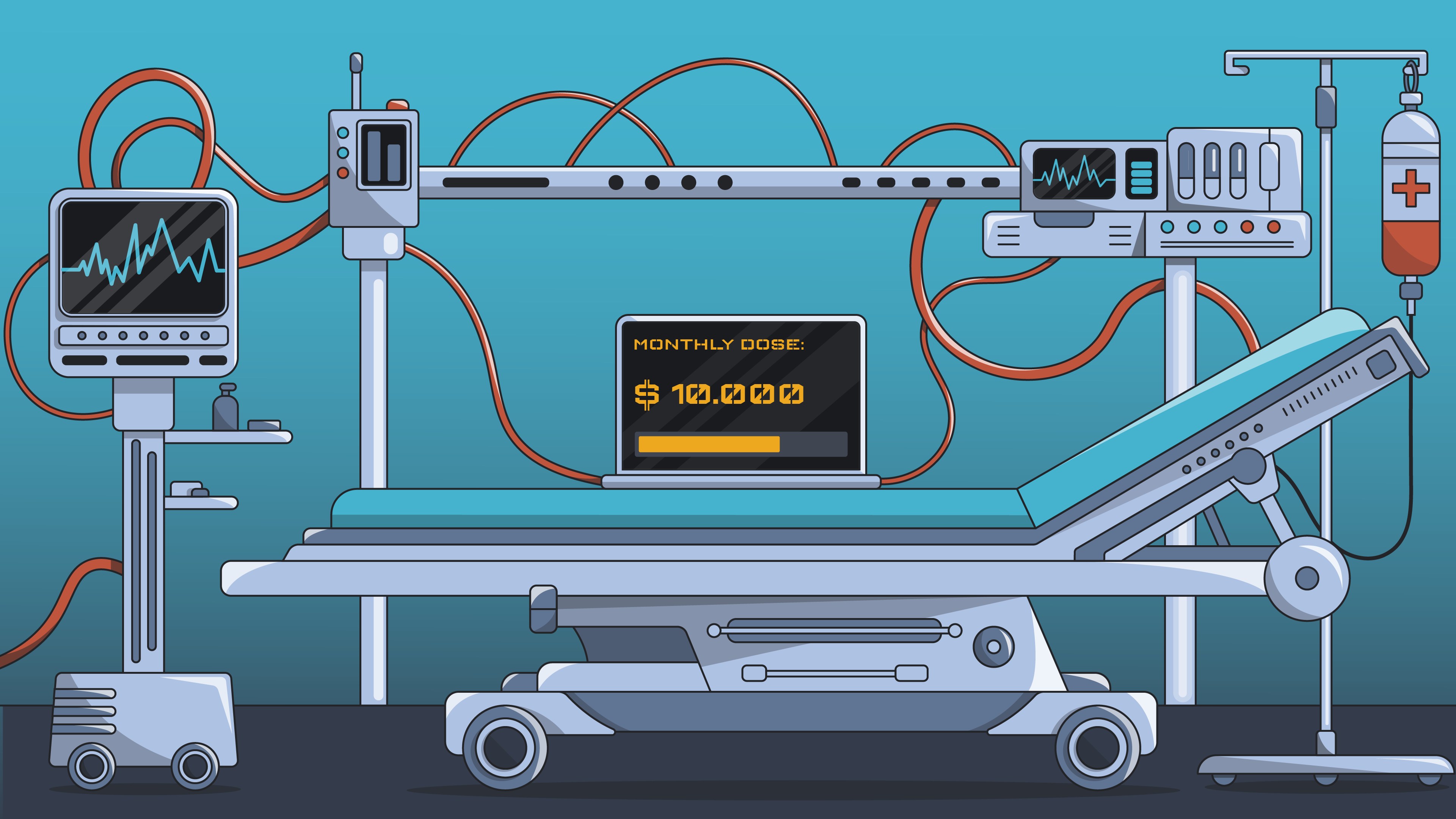

$10K Per Month isn't Just Revenue — It's Life Support

The first $10k of recurring revenue in any startup isn't just "revenue" — it's the difference between living and dying as a startup.

For startups, the best shot we have at living to see a big outcome is not dying along the way. While startups are often focused on "scaling to millions," what they often forget is that long before then it's just about keeping the lights on.

Whenever I'm building a new startup, my first and only focus is, "How do we get to 'life support' revenue so we can survive long enough to figure the rest out?" Having been through this startup phase countless times, I look back and realize that the startups that had the most success were those that were able to weather the (many) downtimes along the way.

Why $10k?

Everyone...

Why do VC's Keep Giving Failed Founders Money?

Failed Founders are some of the best investments because they understand precisely how hard it is to build a startup, and most importantly, are willing to do it again.

Yes, Founders fail. Sometimes, they fail in spectacular fashion (which is harder than it looks), but they do indeed fail. We seem to understand that part well, but what tends to confound many of us is why those same failed Founders can continue to raise more money from investors.

Haven't investors learned their lesson? Don't they understand that the last time they gave that Founder money, they took a monumental loss? Why, with so much evidence that the Founder has practically set their money on fire, would they even think about giving them more?

Well, friends, it turns out t...

If It Makes Money, It Makes Sense

The only product that makes sense right now is the one that makes dollars.

We all want to believe that in the formative days of a startup, all we should be building is the exact product vision in our heads. We should be turning a blind eye to anything that doesn't directly contribute toward that vision. Everything else is a distraction... right?

While that does sound wonderful, it's not only rare, it's also somewhat delusional. The reality is most startups (who aren't funded) need to focus on building stuff that makes money, regardless of whether it's directly contributing to the product vision. And guess what? Sometimes that winds up being the best product investment we can make.

Money = Runway

Let's start with the obvious — we need to get...

The Hidden Treasure of Failed Startups

There is a ton of hidden treasure in failed startups — you just have to know how to look for it, and ultimately, how to capture it.

After my first (not last) venture-funded startup tanked, everyone pretty much ran for the hills. Investors bailed, the team got other jobs, and customers found better solutions. But I kept thinking "We just spent a ton of money to build all of this, can't I capture this value back?"

Then it occurred to me — the same thing is happening for countless other failed startups. All of the assets that they spent millions to build just get buried. Everyone tries to make a last-ditch effort to sell them off, but in most cases, it never works and they just evaporate.

But what if we were the ones looking to dig up that bur...

My Competitor Got Funded — Am I Screwed?

TL;DR: "Oh Sh*t!! My competitor just raised a bunch of funding to do exactly what we're doing. We're done for, right? How can we possibly compete with someone who now has the resources to do all of the things we wished we could do?"

Yes, a competitor just raised some funding. No, it probably doesn't matter.

"Wait, what? How could my competitor raising money be anything but my own personal Armageddon?"

Well, it turns out that when the pixie dust settles after those big announcements, our competitors often have a whole new bag of problems to deal with that we don't. We need to look past the upside of that new capital to understand how most funded startups actually sink themselves with an anchor of funding.

All Fat and Bloated

The very first t...